I am a PhD Candidate in Finance at the Foster School of Business at the University of Washington. I am on the 2025-2026 academic job market.

My current research focuses on household finance, labor economics, innovation & venture capital. Previously, I worked at the Center for Global Development after graduating from Boston University.

Email: dsalman@uw.edu

End of the Road? Autonomous Vehicles and Displacement Risk (JMP)

Abstract

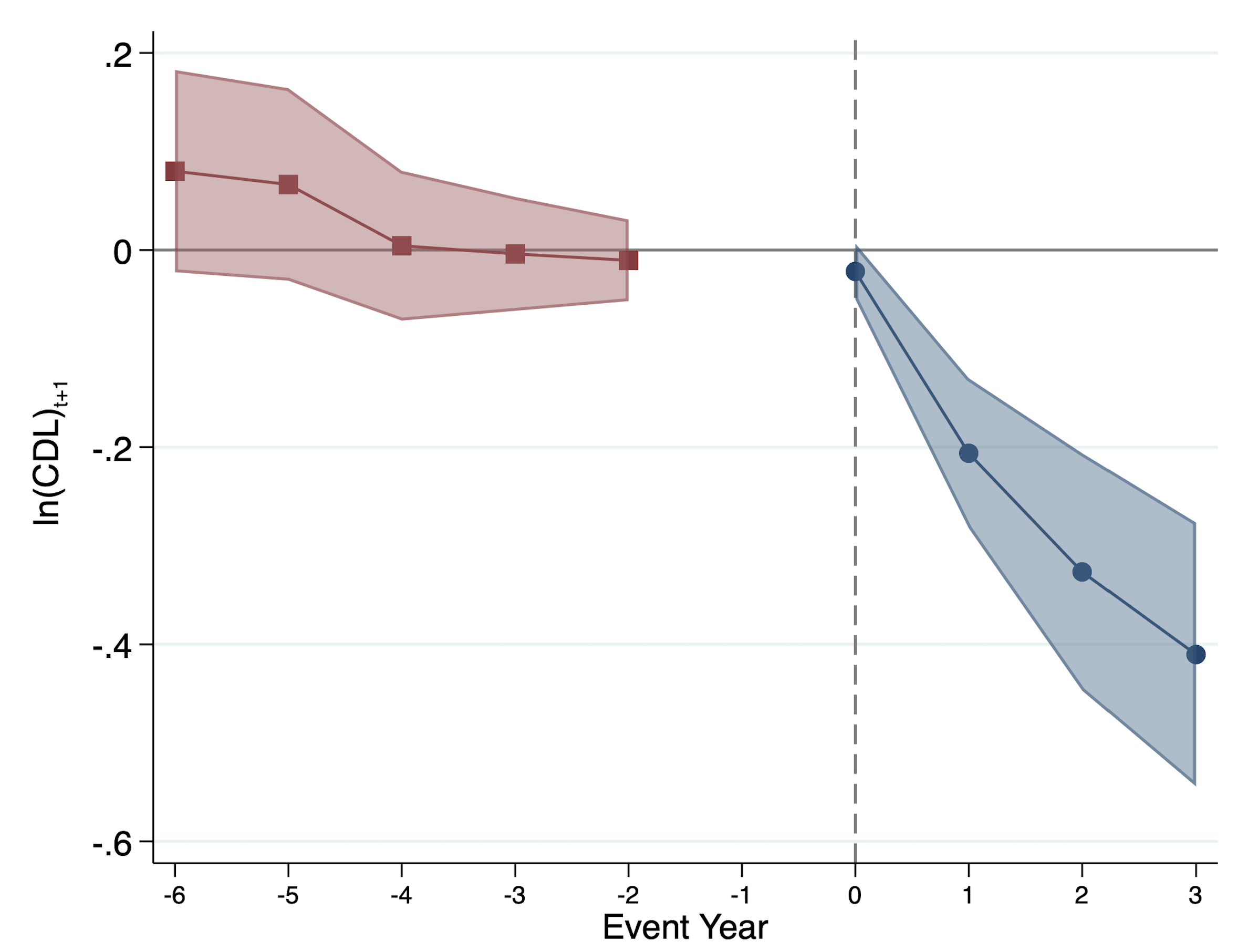

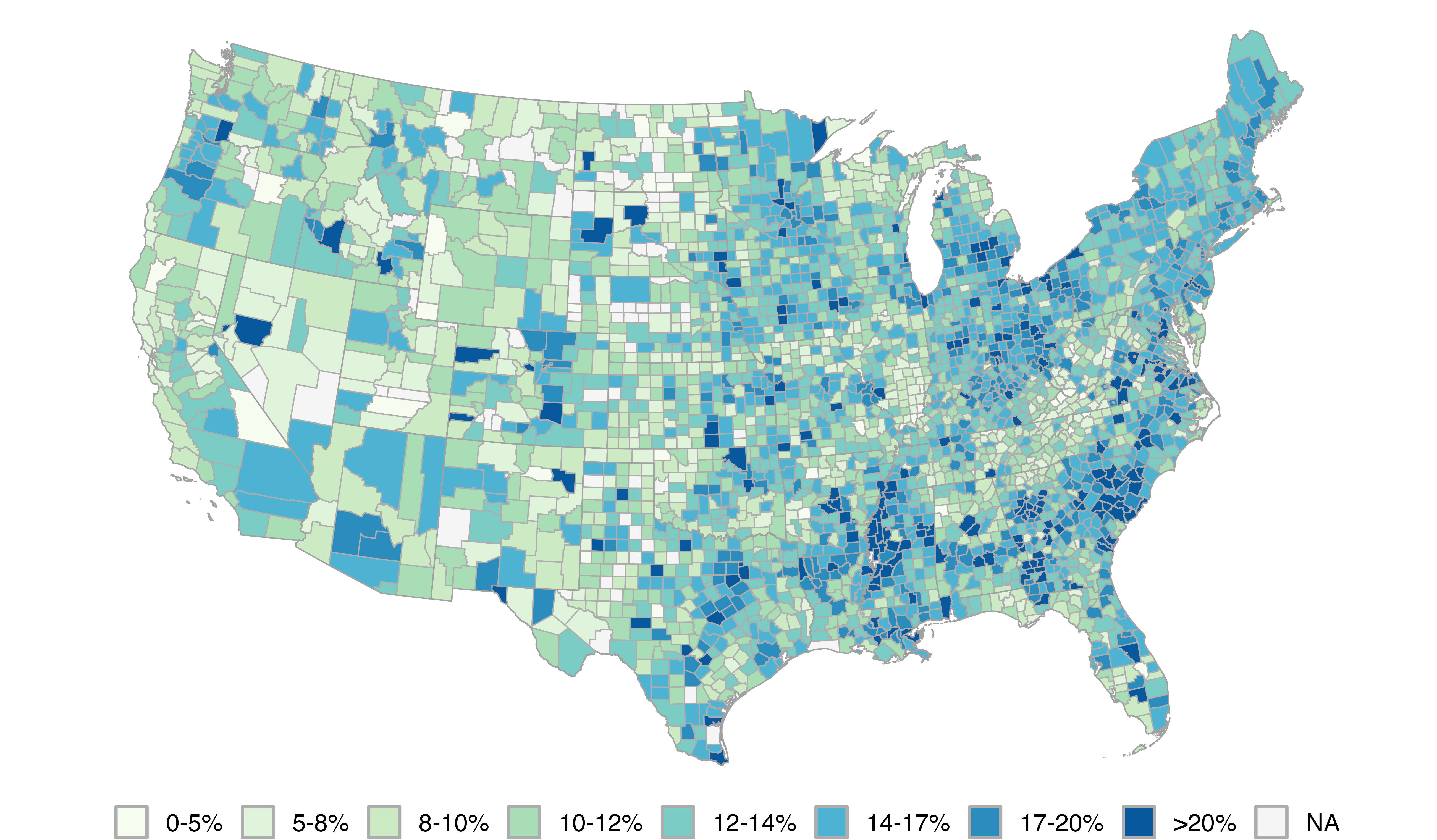

New technologies have renewed concerns about job displacement. In this paper, I link workers' subjective displacement expectations to their direct and social exposure to a disruptive technology: autonomous vehicles (AVs). I find that commercial driver licensing and employment in truck driving fall disproportionately in more AV-exposed areas. The remaining drivers extend their work hours and reduce participation in mortgage markets relative to less-exposed, neighboring drivers. Changes in household spending on alcohol and tobacco products are consistent with heightened automation-induced anxiety. The results indicate that perceived displacement risk affects households' labor supply, credit behavior, and health, all of which could inform welfare assessments and policy responses to automation.

Households take precautionary measures once alerted to the threat of automation

Relief Beliefs: Effects of Anticipated Student Loan Forgiveness (with Xuan Xie)

Abstract

Political support for student loan forgiveness has been growing, particularly on the left, but evidence regarding its effects remains limited. We evaluate the immediate consumption response to President Biden's 2022 loan forgiveness announcement which promised debt relief of $10,000 to $20,000 for approximately 42 million borrowers. We find that retail stores located in counties with a 1% higher share of eligible student loan borrowers saw a persistent 0.1% increase in weekly sales. The positive spending response was absent in counties with high shares of financially delinquent households, consistent with delinquent borrowers being liquidity constrained and unable to smooth consumption. Novel data on debt relief eligibility and applications suggest that student loan borrowers anticipated relief they ultimately did not receive and adjusted their spending in response.

Our results highlight that government debt relief interventions can have stimulatory effects and underscore the role of policymakers in shaping expectations

FMA 2025 Annual Meeting Best Paper Award (semifinalist)

Institutional and Political Determinants of Statutory Tax Rates: Empirical Evidence from Sub-Saharan Africa

(with Sanjeev Gupta, Carlos Mulas-Granados, Jianhong Liu and Kelsey Ross)

Journal of African Development, 2021

The Future of Central America: Challenges for Sustainable Development

Inter-American Development Bank, 2019